January was a rough month for stocks in general, with major global averages falling 5-10% and all manner of sectors (oil & gas, REITs, MLPs, etc) punished far more than that. While there have likely been a lot of babies thrown out with the collective bathwater, one under-performing sector that has especially piqued my interest has been aircraft leasing. There are only four major listed pure-play aircraft leasing companies on US exchanges (AER, AL, AYR, and FLY), making this a small and often misunderstood sub-segment of the broader financials universe. See below for performance this month (in percent):

Aercap (AER), the largest listed player and a close second in terms of global scale to GE’s aircraft leasing business, is one of my largest holdings, so this move has been painful to say the least.

That aside, there have been a number of (often-conflicting) narratives concerning the current business environment for lessors, all of which have weighed on the stocks near-term. To name a few:

- aircraft valuations, especially for older wide-bodies, are under pressure (cf. recent analyst notes, lessor commentary in the last month, and Delta CEO’s claim a few months ago that there was a ‘bubble’ in wide-body aircraft);

- Boeing’s recent production cuts to the 747 cargo plane and also the old-gen 777, suggesting lower demand;

- emerging market pain will cause distress amongst EM airlines (in particular, China exposure is thought to be problematic);

- low oil prices are bad for the lessors since they decrease demand from airlines to upgrade to newer, fuel-efficient aircraft.

Since the lessors now trade for ~25-35% below book value – which, as we shall see, is likely understated in any case – Mr Market is suggesting that a combination of these factors will cause an imminent and material impairment to the carrying value of the lessors’ fleets.

On the other hand, I think the market is too fixated on a couple of isolated and perhaps temporary signs of weakness in the market – ie, tepid demand for new Boeing wide-bodies – and is completely missing the bigger picture (that aircraft leasing is healthy and in a solid go-forward position). Here’s how I get there.

Aircraft leasing: two major ways you can lose (assuming you do indeed lose)

Much like other leasing businesses, there are really only two main ways a lessor can take a large loss: either one or more of its clients goes out of business (or otherwise gets into enough financial trouble that it breaks its leases); or, aircraft held without a lease cannot find a new lessee and need to be written down in value as a result. It is important to recognize that as long as a client is current on lease payments, it would be extremely rare to impair the value of the leased asset (think of car leases as an equivalent example).

This of course means there is and should be a reasonably high correlation between lessor impairments and the health of their clients – the global aviation industry. This is where one of the major tenets of the bear case – that low oil prices are bad for lessors due to a decrease in demand for newer, fuel-efficient aircraft – simply falls apart. The vast majority of the global airline industry is in high cotton; in fact the IATA forecasts that 2016 will be the most profitable year on record for the industry (following on from 2015, which was also the then-most profitable year). Outside of a couple of problematic jurisdictions – Russia, Brazil, and Malaysia, for example – the global aviation industry has never been more profitable.

As you might expect, record profits are prompting many airlines to grow their fleets and expand into new routes – this has caused pressure on yields (‘passenger revenue per available seat mile’, or PRASM), since the addition of capacity generally forces prices down (especially when coupled with lower fuel and healthier airlines competing for share). This may be an issue for airlines’ profit margins on a per-unit basis (though overall profit dollars are clearly still rising). But it is very difficult to reconcile record profits and higher growth at the major airline clients with meaningfully lower aircraft valuations – for the simple reason that there are no major bankruptcies that would cause a flood of un-utilized planes to hit the market. A case in point: AER’s plane utilization currently is 99.3%, and has not dipped below 97.5% since 2005 (from AER Sep’15 investor day presentation):

However, it would still be theoretically possible for lessors to take losses on aircraft coming off lease, if there was not enough extant demand for them to sign new leases at rates that preserved the then-values of the aircraft. This appears to be something of a concern within certain segments of the market, in particular for older Boeing wide-body aircraft. We will look at specific exposures for Aercap in particular shortly, but for now it is important to recognize that leases are generally long-term agreements spanning 10-20 years – often, the majority of an aircraft’s life usable life. Lessors take special care to place and lease aircraft in such a way that large chunks of their fleets do not come off lease at the same time, potentially pressuring residual values. As a result, the idea that a large portion of a given lessors’ fleet could or should be impaired imminently stretches credulity.

Take Aercap, for example. As of end-2014 (the last full year of reported data), an average lease term on a new lease came to 144 months (ie, 12 years), while even re-leases came to 7.5 years. The company also was active in extending current leases with clients, with the average term on extensions amounting to 4 years. In terms of lease expirations, AER discloses that total planes rolling off lease amount to 176 planes in 2016 and 172 planes in 2017 – this amounts to ~14% of their total fleet. Again – this was as of Dec’14, so it is highly likely that a number of these planes to be rolled off have already been re-leased or extended, given current utilization rate is still 99%+.

But even so, digging a little deeper: the Boeing wide-body proportion of AER’s total fleet is ~22%, but the number of Boeing wide-body aircraft rolling off in 2016 and 2017 are only 10 and 20 respectively. This constitutes ~5-10% of total lease roll-offs in either year, or, more importantly, around 1-2% of the total fleet (by aircraft number) or maybe 2-4% of the total fleet by weighted book value. The point is simply that even assuming a) the number of Boeing wide-bodies rolling off in the next two years is this high, and b) it is impossible to re-lease these planes globally at all, and c) a full impairment of these assets is necessary – then even in that case the impact to AER’s net book value is likely only a couple of percentage points.

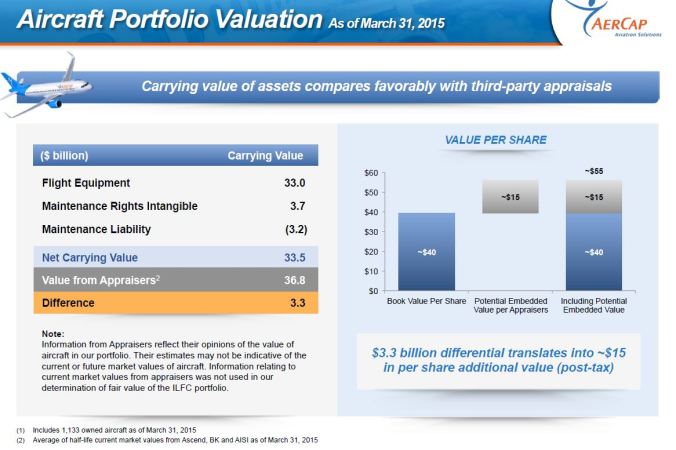

In reality, even this assessment is too bearish. For one – the average age of AER’s fleet is ~7 years, meaning old-tech, less-fuel efficient planes should actually see higher residual demand than in previous roll-offs due to the much higher operating leverage they provide at lower fuel prices. Hence, I expect secondary demand for these kinds of planes, absent near-term volatility, to be solid. Secondly – an independent valuation of AER’s fleet, conducted about a year ago, suggest the net book value of the fleet added an additional ~30% to stated book values as recorded in AER accounts. See below from AER’s investor day last September:

While valuations have undoubtedly come off since then, it nevertheless accords AER a huge buffer against potential impairments in that a good portion of the true value of the fleet has not yet made it into AER’s state book value. As a check on this number, bears may want to consider AER’s long-term track record of trading aircraft: since 2006, AER has sold over 400 planes at an average gain of $1.6m per plane.

Explaining the pessimism

AER now trades at ~70% of (understated) book value whilst generating 15%+ sustainable RoEs, has the best order book in the industry, the most scale and customer diversification in the industry, and has de-levered to the point where it likely gets an investment grade rating in the next 1-2 quarters. Most interestingly, there is a massive disconnect between where the equity trades – a large discount to book, and <2x operating cash flows – and the credit – where benchmark 5yr senior unsecured paper trades just under par and exhibits little if any distress. In my experience, the credit market usually gets it right.

While I have been talking most entirely about Aercap, there is a level of pessimism here regarding the industry that seems far too short-sighted, and I am at a loss as to why these values exist in the market today (this explains why I have been buying!). Boeing’s announced production cuts reflect either weakness in the cargo market (which is almost totally peripheral to AER, and of minimal importance to the lessors generally), or in the pre next-gen delivery schedule for the 777. Indeed, at the same time as cutting the 777 production schedule, Boeing increased the production rate for their narrow-body offerings, suggesting the 777 production cut could simply be an issue of clients not wanting to buy ahead of new tech offerings to be launched from 2020. You could even conceivably argue that OEM supply-side discipline in cutting production is a good thing and supportive of valuations. As I have previously argued, the effective duopoly in aircraft manufacturing is beneficial to the maintenance of such production discipline because ultimately Boeing/Airbus are the biggest losers if they over-produce and flood the market.

Ultimately, I think much of the recent price action can be explained by technicals. AER is a well-owned hedge fund stock, and has signficantly under-performed the more-expensive, less-diversified but less-owned Aircastle (AYR) by ~12% in the last month alone (see above). Not only that, AER has perceived greater wide-body exposure than some peers as well as a larger China business (around 10% of the fleet is in China, though the CEO made pointed comments China’s secular growth outlook for air travel is unchanged). But as this discussion suggests, I view the majority of issues facing the company and indeed the sector as transitory, and the recent weakness as the reaction of the fearful rather than the prescient. At ~$30, the stock could retrace 50% and still look cheap (near 1x 2016 book and 7.3x EPS) – so I have been sizeably adding to my long position.

Disclosure: long AER

Hi. Very interesting writing. I´m also long AER and agree it has been quite painful. I think one angle to analyse this business is the poor free cash flow that generates. Mostly all the profits in this business are in planes and shareholders never get to see the profits via dividends. If you return capital is via debt which increases the risk profile of the company. At some point probably makes sense to invest in AER but you can go bust.

Hi Danilo – thanks for your comment. I agree in principle that dividends would help the stock find a better home amongst some investors. But conversely, AER management has been such a good allocator of capital that it has historically made sense for the management team to retain all operating cash flow and invest that into growing the fleet (or buying back stock opportunistically). Having said that – I anticipate a more robust capital return program (likely a sizable stock buyback plan) once the company attains an investment grade credit rating, which I feel could have in the next quarter or so.

I would think that very low oil, emerging market weakness, and currency issues will put a lot of pressure on appraised aircraft values. Those appraised values are pretty closely tied to future leases and so one would think we will see lower returns on equity for the likes of all aircraft leasing stocks (they’re all beaten up). In some sense buying AER is like taking a normalized view on oil and emerging markets; that is balanced by a deep discount to book value but AER has always traded at a big discount to book. Do you really think oil and emerging markets will normalize soon? Hard to say but I’d say probably not…

Emerging market weakness, low oil, and currency issues have all been features of the environment for two years and yet aircraft values – as measured by transactions at premiums to book value – have only gone up. As discussed in the article – low oil is a huge benefit to the lessors, not a detriment, because it largely removes a huge amount of credit risk relating to their clients’ health (and also more than offsets the strong dollar effect).

I don’t think you need to see ‘normalization’ in oil and EM to see lessors do well. In fact, the sector has really snapped back from distressed levels in a hurry, even though oil remains at very low absolute levels. I still really like the space here.

Really good article! I was wondering if you could comment on the operational challenges faced by a lessor entering into the aircraft leasing market?

I largely agree with the low valuation, but AER has almost always traded at a low valuation to start with. why do you think it should go up? It is cheap but not unsustainably cheap yet.

Pingback: Is the market even semi-form efficient? The Aercap conundrum – Raper Capital