I first wrote up Westshore Terminals (Toronto: WTE) as a short in March last year. You can read the article here. The thesis was basically that this formerly-excellent coal-handling business would be structurally impaired once Teck Resources, a 60% customer, moved the bulk of their volumes to their own terminal, Neptune, from 2021; and that another key customer, Cloud Peak, would file for bankruptcy and be quite unlikely to take up their ~10mtpa commitment because the underlying mines are no longer economically viable.

It was a fairly sleepy first 7-8 months for the trade but things have really heated up recently. In the last few months the following has happened:

– Cloud Peak indeed filed, was acquired out of B/K by the Navajo Nation, and – as I speculated – it now seems quite unlikely the NN will fund the surety obligations to keep the Spring Creek mine operating. This is up to 10mpta of export business that WTE seems unlikely to be able to fill from CPE from 2021-22, because Spring Creek will probably be idled (potentially 30% of pro-forma WTE capacity);

– Teck signed a rail agreement with CN to invest the necessary capital to bring Neptune (their own terminal) into operation from 2021 (even though costs overran the original budget) – signalling both the willingness and ability to ramp volumes at Neptune near-term;

– and today, Teck signed a supplementary agreement with Ridley Terminals – a formerly government-owned port that was acquired by private owners last year – to rail up to 9mtpa through Ridley from 2021-27. You can read the press release here. The stock is down 10% today on the news, but as per below I think it is an even better short now than before this announcement.

This last component was a bit of a surprise (in terms of the speed of the agreement) but the upshot for Westshore is ominous. Teck exports ~25mtpa in total at the moment (19mtpa through WTE, 6mtpa through Neptune/Ridley) but from mid-2021 it appears Ridley will be able to take up to 9mtpa (they have excess capacity), while Neptune nameplate capacity is going to 18-20mpta. Even if we assume a lowish operating rate on the new capacity of say 70%, this would still imply 13mpta at Neptune and 6+mpta at Ridley – reducing massively the tonnage going through Westshore. In other words its not an exaggeration to say by the mid-2020s Westshore may see volumes from Teck drop to near zero, post this Ridley agreement (assuming a further ramp to full utilization)…and that is irrespective of what happens to the rest of WTE’s volumes (mostly thermal coal exporters like CPE who are loss-making and largely insolvent, today). The worst-case scenario I originally posited – that WTE could end up becoming a stranded asset – looks to me much closer to a base case outcome than originally thought.

What is the value of Westshore today?

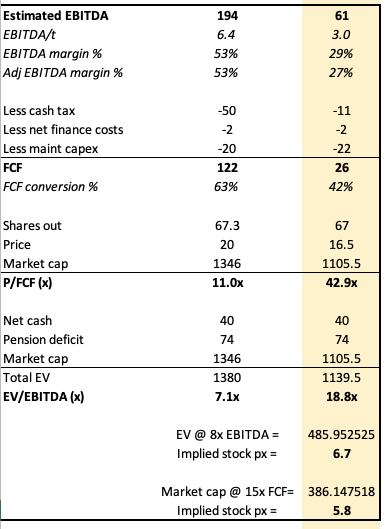

I have commented previously regarding the huge fixed cost nature of this business and how the earnings power will likely be obliterated as volumes decline. This is something still lost on the sell-side, however (consensus 2022E EBITDA/FCF is still $156mm/$96mm vs FY20E EBITDA/FCF of $225mm/$135mm). But let’s run through the assumptions again and see what WTE may be earning on a go-forward basis from 2022:

- Teck volumes: currently 19mpta, I now assume 5mpta based upon 70% utilization at new Neptune and the Ridley contract, and essentially flat pricing ($12/t loading charge). This I feel is very generous given the above but let’s run with it;

- Cloud Peak: volumes were meant to escalate to 10mpta by 2022; since NN likely can’t keep the mine operating I don’t see how this is possible but nevertheless I assume flat volumes at lower loading rates (to try to keep CPE in business);

- Other volumes: I assume WTE finds an incremental 3mtpa from other clients (maybe Riverdale comes online) but at lower rates as they need to desperately try to fill capacity;

- SG&A: assume large cost cuts and overhead falls to 2013 levels;

- Labour costs: assume 70% fixed costs (in line w history) – limited ability to cut here here since a new labour agreement was negotiated in 2017, this is a unionized labour force and the co is not a going concern risk (just much less profitable).

Add it all up and the PnL looks something like this:

And the business only does ~$60mm in EBITDA (vs $150mm+ consensus) and barely any FCF ($20mm or so):

As per the lower section, I think this kind of business – newly disenfranchised with clear stranding risk – would be generously valued at 15x FCF or a high single digit multiple of EBITDA. This implies a stock price in the $6-7/share range, to which we must add whatever FCF (or more accurately, dividends) can be generated between now and this new steady-state. Let’s be generous and say that is two years – 2020 and 2021 – using consensus FCF per share as a proxy (around $4 total across both years, undiscounted). Even in this fairly generous scenario its hard to see how the stock is worth more than $10 CAD, today – or another 40% downside. But in reality, since there is no going concern risk, the company would probably dedicate a good portion of that FCF to repurposing the asset (towards lumber export, for example); and at the same time it seems fairly certain Teck volumes disappear completely over the course of time. That’s why I added to my short today and think this sees a high-to-mid single digits stock price (so 50-60% downside) over the coming 18 months.

Disclosure: short WTE.CN

Pingback: Ideas of The Week: January 11, 2020 - Value Never Sleeps

Seems like Westshore intends to buy back shares in the near future, which haven’t been done for a while. Considering the need for a cash buffer in the base case, do you think anything has changed? , specifically with the upcoming contract renewal/renegotiation with Teck?

Thanks

nothing has changed. in fact the coal market fundamentals are far worse. they are not buying back much stock and who knows if they even execute the buyback. wasted $$ in my view