I wrote up Shinoken (8909.JT, listed in Tokyo) here about 6 months ago. At the time the stock was trading at <4x earnings, <3x EV/EBIT and at a considerable discount to replacement cost, due to the overhang of a number of scandals in the build-to-let apartment industry in Japan and a misunderstanding of the company’s business model. Today – post impressive FY19 results – Shinoken has re-rated >50%, and now trades at ~6x LTM earnings and 4.7x LTM EV/EBIT. But given the changes in the industry and how Shinoken’s business model has continued to evolve, it is a much better risk/reward today and still massively undervalued. I think a conservative fair value today is somewhere around 2400-2500 JPY/share – that is, basically another double from here – and more importantly I think downside risk is much lower now given how Shinoken has reshaped their balance sheet through the crisis.

A year ago – just a few months in to the scandal – Shinoken still possessed a reasonable amount of financial leverage: at year end FY18, the company had 29bn of net debt against book equity of 30bn – hence, almost 100% debt/equity – and LTM EBIT of 12bn (so 2.5x net debt/EBIT). Note that I give no credit for inventories on balance sheet (a very conservative assumption, as we shall see) but in any case the point is they still carried a meaningful debt load – which was used to finance short-term inventory for development. Essentially the model was, borrow to finance land and inventory; build the apartments in 6-9mos; sell the apartments for a small gross profit; then book recurring revenues from managing the apartments for a very long period of time.

As the market froze up in early 2019, Shinoken moved quickly to reduce risk by stopping land acquisition – instead they sold some buildings a bit more aggressively (without taking losses) and allowed the existing pipeline to roll through the inventory in progress letting the company repay a huge amount of debt as this inventory was sold. Essentially the company accepted lower returns on its capital – by choosing to hold more capital without actively seeking to recycle it during the year – whilst the market remained unstable (namely Tateru, 1435.JT, was liquidating most of their land bank/inventory during this time).

As a result, at year end 2019, the balance sheet looks remarkably different. Book equity is up to 35bn JPY (despite some modest buybacks during the year) – since Shinoken remained solidly profitable and never took losses. But they delevered to the tune of 25bn JPY over the year, through a combination of inventory liquidation (20bn or so) and cash generated in the business (5-6bn) – meaning at year end net debt is just 4bn JPY – that is, 11% net debt/equity and 0.4x debt/EBIT.

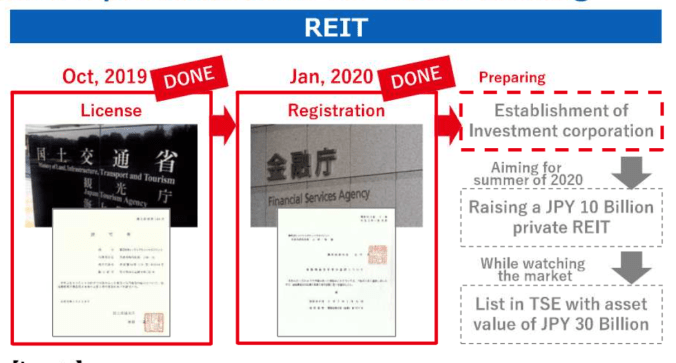

Whilst of course returns came down as a result – pre-tax ROIC as I define it fell from 38% to 30% year over year – the result is a balance sheet that is now clearly under-levered and well positioned to accelerate as the business returns to growth – something Shinoken guided towards with their 2020 guidance (calling for 10%+ growth in EBIT and net earnings, numbers that are historically conservative and that I expect the company to beat quite handily). In fact, with Shinoken actively guiding towards the launch of a listed REIT by the summer – I interpret this as by July this year – in the size of at least 10bn JPY (and potentially up to 30bn JPY), it is almost guaranteed (in my mind) that the development business returns to meaningful growth. Development revenues, after all, were ‘only’ 57bn last year – down from 78bn in 2018 – without the benefit of any REIT demand. It stands to reason that with 10-30bn asset value of REIT demand from 2H’20, the development business will start to produce teens growth, at least, driving higher asset turns and better returns on capital than we saw in 2019.

Meanwhile, the transition from being a development business to being a recurring, fee-based business is ongoing and shows no signs of stopping. Exiting 2018 the company made 66% of its EBIT from development; in 2019 this was just 52%. Of course as and when the REIT business begins, this will generate – you guessed it – more recurring fees to the Shinoken group – deserving of a structurally-higher multiple. All this for 4x 2020E EBIT…

What’s going on in the broader industry

Apart from the stability and derisking at Shinoken specifically, the reason I am so excited about this opportunity now is because the broader industry remains in flux. One of Shinoken’s main direct competitors, Tateru – indeed, one of the progenitors of the crisis, given the loan documentation-fudging they perpetrated that got caught in 2018 – is basically in wind-down mode and has completely pivoted their business model away from apartment development, and towards services.

You can see this in their FY19 results presentation below.

Sales (top box, top row, circled in red), fell precipitously in 2019 (79bn to 19bn), and are guided to drop again in 2020 – to 6bn (second box, top row, circled in red). Since the vast majority of this was development revenue, this is essentially Tateru exiting the development market in totality (this often happens when the Japanese authorities come down on troubled companies that break the rules).

Whilst the two offerings – Shinoken’s and Tateru’s – were not identical, Shinoken is probably the closest comp for Tateru in terms of offering to the consumer (both buy-to-let apartments in major cities marketed as income properties to salarymen). In any case, if 70bn of asset value in development leaves the market, it should be good for all the remaining players (cheaper land acquisition, better bargaining power with potential purchasers, etc) – and especially so in a tight market. How do we know the market is tight? Well, despite Tateru’s reputational issues, their apartments – that is, the ones they had already built and are managing – are all still basically full, with 98.8% occupancy on its 26k room bank:

Shinoken, too, reports no change in its ongoing extremely high occupancy ratios (around 99% vs national averages around 82%).

With a delevered balance sheet, then, and all the regulatory hurdles regarding establishment of a REIT concluded, it would appear Shinoken is ideally placed to take greater share from the exiting Tateru and return to its former growth trajectory.

Leopalace shows how cheap Shinoken really is

The recent travails of another developer/manager, Leopalace (8848.JT) further demonstrate how unique of a bargain Shinoken is today at 4x EV/EBIT with no net debt. Leopalace further contributed to the sector’s doldrums in 2019 by the discovery of shoddy building standards that require the repairs to a huge number of their historically constructed buildings (around 13,000). Of late, however, the stock has been rallying because the company appears to have become an activist target (see here); they have committed to restructuring the business; and now they have fully diagnosed the extent of the construction quality problem, the market is taking the view that the worst is over and the stock looks ‘cheap.’

It is particularly this last part that i have trouble with, since even if you assume the amounts Leopalace has provisioned for remedial construction don’t go up further, they only include ‘serious defect work’ (not minor defects which may still need to be repaired) in their cost accruals thus far; and also the company has only completed <10% of repair work (out of 13,000 buildings that need repairs) so there is plenty of time and scope for cost overruns. But EVEN on this basis, the pro-forma EV for Leopalace is around 160bn (see below) and the company is guiding to getting back to 12bn EBIT in two years (assuming cost cuts stick and they get occupancy back close to prior levels and margins bounce back most of the way – ie, quite optimistic):

In other words the market is putting a 13x EV/EBIT multiple on this no-growth leasing company with going concern risk that is not even growing (Leopalace’s development business is dead, and they sold most of their other businesses to pay for the repairs), two years out…I really don’t get it. Leopalace is not even that much bigger/more liquid than Shinoken either (95bn mkt cap vs Shinoken 45bn), they just seem to have a more foreign shareholder base and the hint of activism going on at the board level. But they are significantly more levered on an adjusted basis; exposed to open-ended cost overrun risk; and don’t have a credible growth story in development anymore.

Over time – and as Shinoken demonstrates its ability to regrow organically in 2020 – I expect a lot of the hot money chasing the likes of Leopalace will gravitate to higher-quality, if smaller names, like Shinoken.

Updated Sum of the Parts

Here is how I get to >2400 JPY/share for Shinoken. Note that I accord NO value to the REIT management fee stream (either domestically or in Indonesia, where they have been accruing some costs to launch business this year); and no value for inventory on balance sheet (essentially assuming it is consumed entirely within the capitalized multiple of the development business); so I feel I am being conservative on most all fronts. In reality I think it is not hard to see this business being worth closer to 3000 JPY/share once the REIT business develops in a couple of years…but >100% upside still seems very reasonable for now.

Shinoken remains one of my largest positions.

Disclosure: long Shinoken (8909.JT)

great anslysis. thanks

thanks 🙂

great post

thanks 🙂

Interesting idea. I’ve just had a quick look at the numbers and I’m wondering how you got to ~6x LTM earnings and 4.7x LTM EV/EBIT. LTM reported earnings were 5.86b yen, and with 34.2m shares outstanding (less treasury shares) Shinoken’s market cap is 43.18b @ current price of 1263 yen. That implies P/E of 7.2.

sorry, maybe my math was off a bit. it doesn’t really change the argument since i look at it on forward earnings/EBIT and on that basis – even ref 1260, vs the stock now at 1150 – I had it at 5.5x earnings on my numbers

sorry for my confusion, but are you saying the 5.5x multiple is P/E or EV/EBIT? thanks

I see that mgmt guidance for fy20 EPS is 204.7, so I’m guessing now that you meant earnings

Thanks. I just listened to the Eric Schein podcast too. This could very well be my first direct Japanese investment. I quite liked your take on the Aussie market due to the trillons of super trying to find a home.

many thanks Christian 🙂

Welcome, Christian, to the global community of Shinoken fans

you/re in Australia, I’m in NYC, Jeremy is in London. So maybe we could all meet in the center of the Earth for some sake once this thing works out

Maybe. Singapore is probably the safest place on earth though it seems more appropriate to visit Japan. And I want to walk the Kumamo Kodo. I’m still waiting for my buy order to go off as I’m stingy.

great post. Have you made inquiries into the character of the operators and large owners? Given no debt, seems to be the only potential risk and something somewhat difficult to figure out from a distance.

How do you calculate the 30pc ROIC for this co? Seems more like midteens using total capital.

hi there – I subtract cash as its essentially all non-operating (inventories fully cover ST debt many times over). do that and pre-tax ROICs are >30% (although still lower than in prior years)

thanks for the insight, I am a little confused that the company is selling the apartment and also renting at the same time? So If I am the owner, I buy the apartment and Shinoken will help me rent out to earn money? It is more like a service apartment?

Thanks for the analysis. Great work

Pingback: Quicky #17 on Shinoken (8909) – searching 4 value